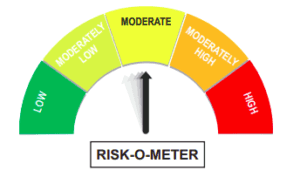

As per SEBI guidelines, mutual fund schemes are to be labelled according to the level of risk involved and the same is to be depicted on the risk-o-meter. You might have this risk-o-meter in a newspaper advertisement of a mutual fund or in the scheme document of a particular fund.

The risk-o-meter with different labels of risk is depicted as below:

- Low: Principal at low risk

- Moderately low: Principal at moderately low risk

- Moderate: Principal at moderate risk

- Moderately High: Principal at moderately high-risk

- High: Principal at high risk

Investors should not be carried away by commission/gifts given by agents/distributors for investing in a particular scheme. On the other hand, they must consider the track record of the mutual fund and should take objective and informed decisions.